"When the pandemic ends, most people will get back to normal, but we're going to be feeling the pain for many years to come."

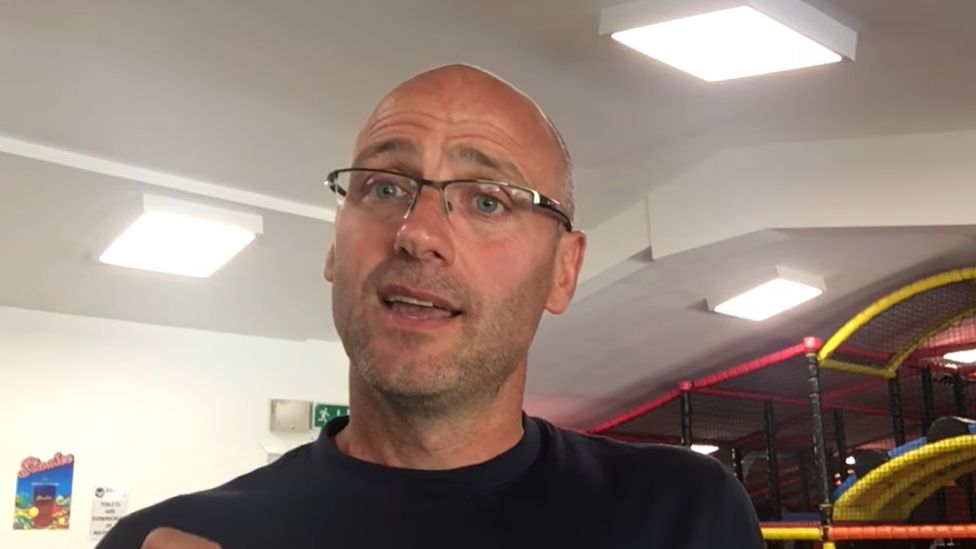

Craig Meikle is talking about his business - a soft play and football centre in Dalkeith, Midlothian.

The soft play area, which provides two-thirds of the firm's income, has been closed since March 2020 and a date for reopening remains uncertain.

"It's going to be a real struggle," he says.

Before the pandemic the centre was ticking over nicely, turning over £750,000 each year, Craig says.

Craig and his wife were about to make their final payment of a business loan they had used to build and develop the soft play centre.

"We were debt free," he tells Radio 5 Live's Wake Up to Money programme.

But the pandemic restrictions meant they had to shut down and, like many other small business owners, seek financial help, which has largely come in the form of government grants and state-backed loans.

The Meikles have received grants from the Scottish government, taken out a Bounce Back loan and borrowed from the Coronavirus Business Interruption Loan Scheme, or CBILS, totalling £100,000.

The first repayments of Bounce Back loans were due this month.

Craig says they also owe thousands of pounds in rent.

"We owe up to £130,000. That's a conversation that I still have to have with the landlord who has been amazing with us to be honest… at some point we're going to have to have the conversation."

Altogether, the couple has a business debt pile of £250,000.

A survey carried out by the Federation of Small Businesses (FSB) in March showed a quarter of its members had taken on more debt to get through the pandemic. The FSB said it is concerned that firms hit hard by the ongoing restrictions are now facing unprecedented amounts of debt.

Business borrowing during Covid

More than 1.6 million businesses have used the government-guaranteed Covid loan schemes, which are:

- Bounce Back Loan Scheme (BBLS)

- Coronavirus Business Interruption Loan Scheme (CBILS)

- Coronavirus Larger Business Interruption Loans Scheme (CLBILS)

Between them, those businesses have borrowed a combined £75bn.

FSB national chairman Mike Cherry told the BBC: "Five whole quarters without revenues is unprecedented, so we believe that no business kept closed by the restrictions, and therefore unable to raise any revenue, should be pursued for their Bounce Back loan."

Meanwhile the head of economics at the British Chambers of Commerce, Suren Thiru, said: "Practical solutions will be needed to prevent a large number of firms across the UK from falling into a spiral of unsustainable debt."

Lenders have said they will treat customers fairly, while doing their best to avoid triggering government guarantees that could cost the taxpayer billions of pounds.

'I'll have to work over 100 hours a week'

In order to clear the debt, Craig says he will need to work longer hours and cut the number of workers they employ.

"Our business is a family-run business and we're going to have to have less staff and do more hours ourselves.

"I do 60 hours a week, sometimes 80, so I'll have to be doing over 100 hours."

Like Craig, Luci Clayton-Jones had to take out a government-backed loan during the pandemic. She runs Double Barrelled Brewery in Reading, which opened 18 months ago.

"When we took that loan out with a year grace period, we never anticipated that rightly or wrongly a year later we would still be facing restrictions and we would still be dealing with a market that isn't at its full capacity," she tells the BBC.

"We're now in a situation where we are looking at paying that back but we're still faced with ongoing increased costs as a business and a market that is at 65% of its normal volume.

'Cash is king - and I don't have enough of it'

"Ultimately I'm looking at our cash flow over the next couple of months and thinking, with the industry how it is at the moment, I'm not sure that we can sustain this."

This comes as many businesses face some important deadlines for their finances.

On 1 July employers must start contributing 10% towards furlough costs, and 100% business rates relief tapers off to 67%.

A ban on commercial rent evictions was due to end on 30 June, but the government has now extended it for another nine months.

"Cash is king and at the end of this month I've got to pay our rent bill, I've got to pay our team and at this point in time I don't have enough cash in the bank to be able to do that. And that's a horrible position to be in," Luci says.

"And having additional restrictions - I understand it - but it puts us in a much less likely position to go forward."

"Hour" - Google News

June 17, 2021 at 06:48AM

https://ift.tt/3gIQrDb

'I'll work 100-hour weeks to clear our Covid debt' - BBC News

"Hour" - Google News

https://ift.tt/2WcHWWo

https://ift.tt/2Stbv5k

Bagikan Berita Ini

0 Response to "'I'll work 100-hour weeks to clear our Covid debt' - BBC News"

Post a Comment